WLFI Token listed – How to buy Trump’s coin – How to open a position in Futures?

Donald Trump and his family-backed decentralized finance (DeFi) initiative World Liberty Financial (WLFI) officially entered the market today. The project’s native token, WLFI, was launched on the Ethereum network, with the first listings going live on September 1 at 13:00 UTC. Following its debut, the token quickly stood out in terms of market capitalization, positioning itself as one of the most notable cryptocurrencies in circulation.

World Liberty Financial, which began operations in 2024, is a DeFi platform aiming to bridge traditional financial products with on-chain infrastructure. Supported publicly by U.S. President Donald Trump, Donald Trump Jr., and Eric Trump, the project has drawn significant attention, blending both political and financial dimensions.

The protocol operates on Ethereum and utilizes Aave V3 for lending and borrowing activities. With audited reserves and established custody relationships, the project emphasizes user security. The WLFI token serves as the platform’s governance token, enabling voting on protocol parameters, incentive programs, and growth initiatives. Initially non-transferable, the token was approved for trading by the community in July.

The launch of WLFI comes after months of fundraising, insider-linked purchases, and cautious stances from analysts. This debut has sparked excitement, combining hopes of quick gains with concerns over centralization. The project not only generates buzz within the crypto space but also stands out globally as one of the most significant developments of the week.

The listing of World Liberty Financial’s WLFI token marks not just the rise of a new DeFi product, but also a powerful milestone at the intersection of politics and finance.

WLFI coin is currently trading at $0.21.

The market capitalization is $5.46 billion.

The fully diluted market capitalization is $21.69 billion.

The circulating supply is 24.66 billion WLFI.

The total supply is 100 billion WLFI.

By market capitalization, it is the 26th largest token.

WLFI token is currently trading at around $0.22, which represents a significant return for the early whitelist buyers who initially purchased at $0.015 per token. This translates to a gain of over 1,300%.

WLFI is now listed on all major exchanges such as Binance, Bybit, Coinbase, Upbit, OKX, MEXC, Bitget, and KuCoin.

Donald Trump Jr., co-founder of World Liberty Financial, said on X, “Big day! World Liberty Financial has launched the WLFI token. This is not an ordinary coin; it is the governance backbone of a real ecosystem that is changing the way money moves. Freedom, finance, and America FIRST. Home Team.

Where and how can you buy World Liberty Financial (WLFI)?

We can easily buy the WLFI token on Binance. Now, I will show you step by step how to buy it both on the spot market and the futures market.

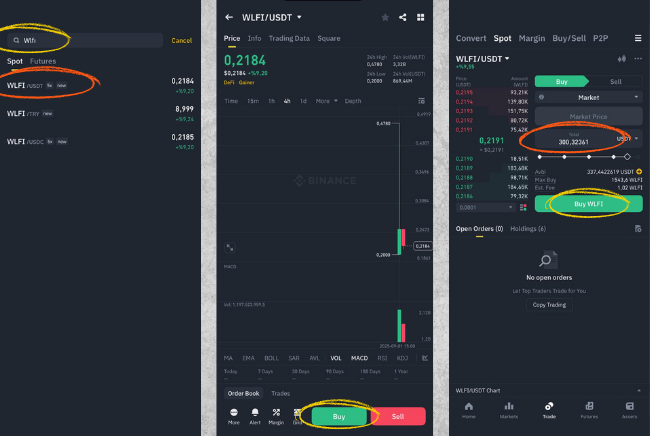

How to buy WLFI on the spot market?

Log in to Binance.

Click on the Markets section at the bottom.

Type WLFI in the search bar.

Go to the WLFI/USDT pair.

Select the Buy option.

Enter the amount you want to buy.

Click Buy WLFI, and the WLFI token will be purchased

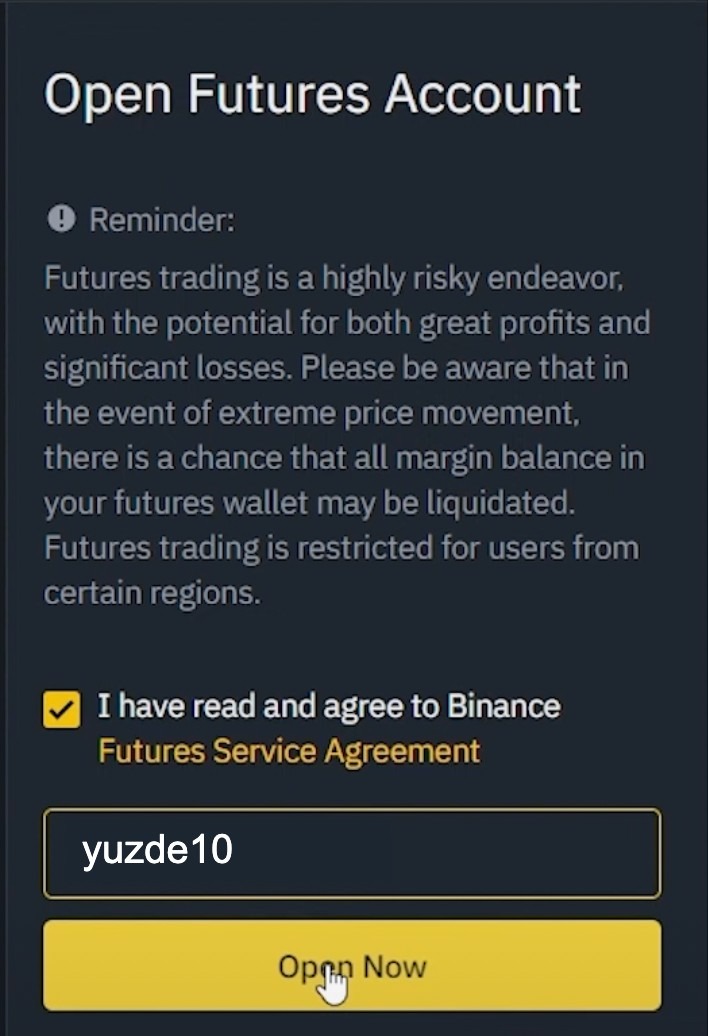

How to open a futures position with the WLFI token?

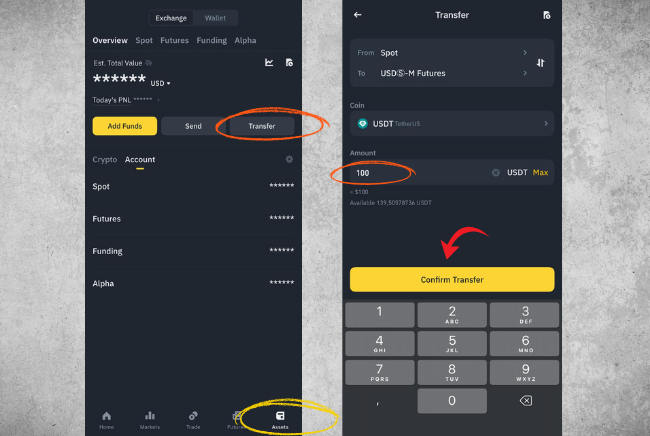

For this, you need to transfer funds from your spot account to your futures account.

Go to the homepage and click on Assets at the bottom right.

Select Transfer.

Enter the amount.

Click Confirm Transfer.

Your funds will be transferred to the futures account.

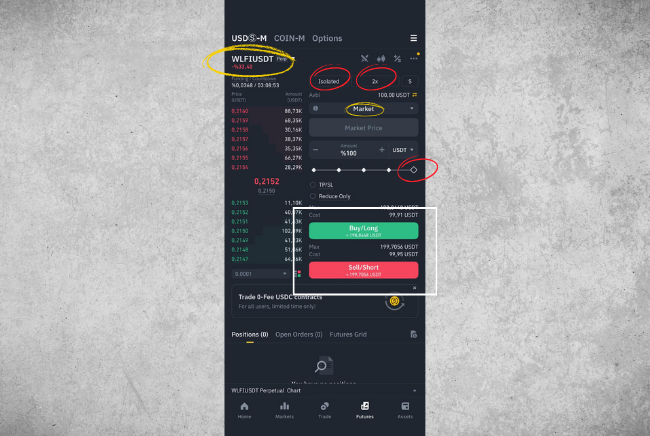

Click on Futures from the homepage.

Go to the WLFI/USDT pair.

Select Isolated mode for beginners.

Choose the leverage amount (it’s better to use low leverage for newly listed coins due to high volatility).

Select Market order to enter the trade at the current price.

Enter the amount you want to trade.

If you expect the price to rise, choose Long; if you expect it to fall, choose Short.

The position will be opened.

What I have explained is not investment advice; these are my personal opinions.

The cryptocurrency market is highly volatile; prices can change dramatically in a short period. This can lead to significant losses for investors during sudden drops. Additionally, regulations and news flow can directly impact prices.

In the futures market, using leverage increases risk. In leveraged trading, investors trade with multiples of their margin; even small price changes can result in large gains or losses. A wrong position can lead to the loss of the entire margin. There is always a risk of liquidation in this market, making strategy management crucial.

English

English