Why Percentage Drops and Gains in the Crypto Market Are Not the Same

Why Are Percentage Drops and Gains in Crypto Markets Not the Same?

When a coin’s price falls in the crypto market, many investors often think:

If it dropped by 50%, a 50% rise will bring it back to its original level.”

However, this assumption is completely wrong.

In financial mathematics, percentage decreases and increases do not offset each other. This is because percentages are always calculated based on the current price, not the initial price. Therefore, to recover from a drop, a higher percentage gain is always required.

Examples Explained

When an asset loses 50% of its value, it needs to rise not by 50%, but by 100% to return to its previous price. For instance, if a coin drops from $100 to $50, it must double in price to reach $100 again.

Similarly, the situation for other declines is as follows:

A coin that drops by 10% must rise by about 11% to recover.

A 20% drop requires a 25% rise to return to the original level.

After a 30% drop, a 42.8% increase is needed to recover.

A 50% drop requires a 100% increase.

A 75% drop requires a 4x rise.

A 90% drop requires a 10x rise.

A 95% drop requires a 20x rise.

And a 99% drop requires a full 100x rise.

These examples clearly show why recovery takes so long after major price drops and why investors must understand the difference between percentage losses and percentage gains.

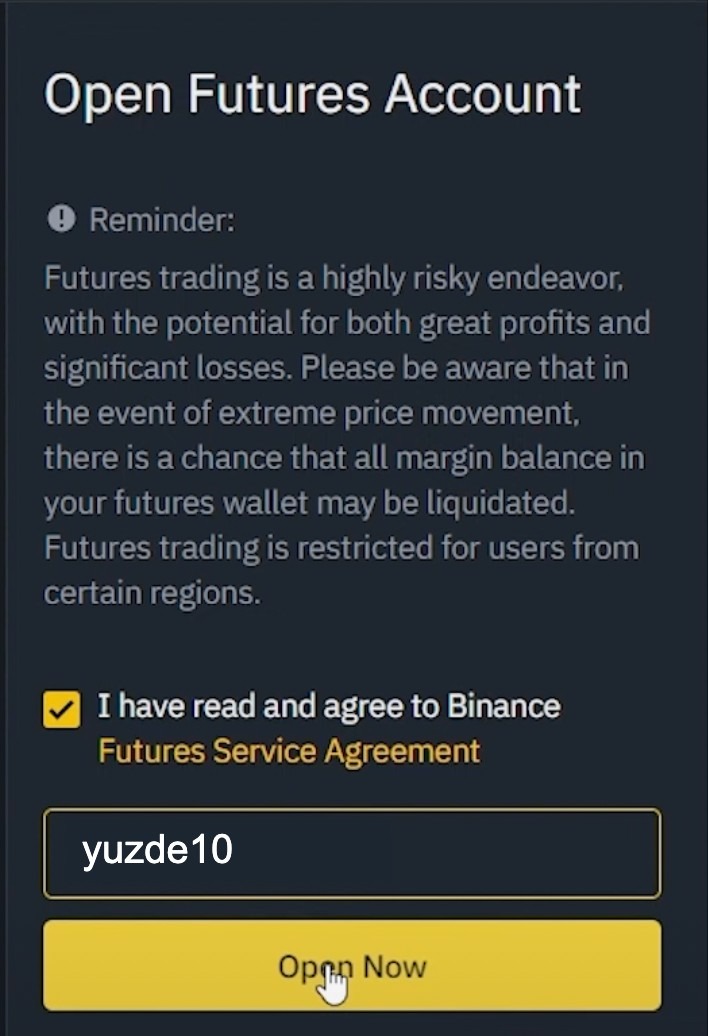

Connection with Futures Trading

For futures traders, this difference is critically important.

In the futures market, price movements are amplified by leverage — but losses can grow just as fast.

Many traders assume that if the price drops by 10%, a 10% rise will recover their loss.

However, this assumption is incorrect — especially for highly leveraged traders, it can often lead to liquidation.

For example:

Imagine you open a long position at $100.

If the price drops by 50% to $50, your position is almost completely wiped out.

To return to $100, the price needs not a 50% rise, but a full 100% increase.

Understanding this difference provides a major advantage in risk management.

Adjusting your position size, leverage ratio, and liquidation level with this in mind helps you build a sustainable and controlled trading strategy over the long term.

For example, this difference should not be ignored even during small price drops.

If a $10 coin loses 20% of its value, it falls to $8.

However, to rise back from $8 to $10, it needs not a 20% increase, but a 25% gain.

As you can see, after every decline, the percentage required for recovery is always higher than the percentage of the drop.

In short, declines are much deeper than they appear — recovery always requires more effort. Prices in the crypto market can drop quickly, but returning to the same level demands patience, strategy, and proper risk management. Investors who understand this difference can take calculated and informed steps rather than reacting emotionally. Major declines can turn into opportunities with the right approach, but a superficial view can enlarge losses and delay recovery. Therefore, analyzing every drop mathematically is key to staying resilient in the market over the long term.

English

English