What is PAXG and How to Open a Position in Crypto

What is PAXG (Pax Gold)?

During times of crisis, investors have always turned to gold as their first safe haven. Now, the same security is available with the speed of blockchain and the convenience of crypto: PAXG.

In the world of cryptocurrencies, the convergence of digital assets with real-world assets is becoming increasingly important. One of the most notable projects in this space is PAXG (Pax Gold).

PAXG is a cryptocurrency where 1 PAXG represents 1 troy ounce (approximately 31.1 grams) of physical London Good Delivery gold. In other words, holding PAXG means you actually own gold stored securely on the blockchain.

All PAXG tokens are 100% backed by physical gold and are stored in one of the world’s most secure vaults, Brink’s.

Why PAXG?

Divisible → Unlike physical gold, PAXG can be divided into even very small portions, allowing you to buy fractional grams.

Fast Transfers → Thanks to blockchain technology, you can send gold anywhere in the world within seconds.

High Liquidity → PAXG is listed on major exchanges like Binance, Kraken, and KuCoin, making it easy to buy and sell.

DeFi Usage → PAXG can be used as collateral in DeFi protocols, enabling investors to borrow, lend, and earn interest.

PAXG and Gold Prices

The value of PAXG is directly linked to the price of gold per ounce.

When gold prices rise, PAXG also increases in value.

When gold prices fall, PAXG decreases proportionally.

For this reason, PAXG is often used as a hedge against inflation.

What Does “Ounce Price” Mean?

The standard unit for trading gold in international markets is the ounce.

1 ounce = 31.1 grams of pure gold.

Globally, gold prices are usually quoted in “dollars per ounce” (XAU/USD).

So, when you hear that “gold is $2,500 per ounce,” it means 31.1 grams of gold is worth $2,500.

PAXG mirrors this ounce price exactly, allowing you to track global gold price movements directly on the blockchain.

Why PAXG Matters

PAXG stands out because it bridges traditional finance and the crypto world while offering investors a safe-haven asset.

It serves as a bridge for those who want exposure to the gold market without leaving the crypto ecosystem. In a sense, it’s like putting the gold from a vault into your pocket and bringing it onto the blockchain.

Important Warning: Funding Fee

If you keep your position open for a long time, you may have to pay the funding fee in a positive funding scenario.

This can increase your position costs and reduce your profits over time.

How to Open a Futures Position with PAXG

Log in to your Binance account.

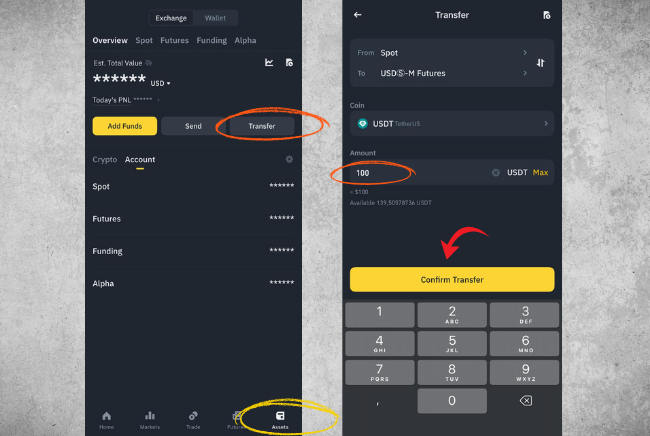

Click on the Assets section at the bottom right.

Select Transfer.

Enter the amount you want to transfer.

Confirm the transfer by clicking Confirm Transfer.

This way, you move funds from your Spot wallet to your Futures wallet.

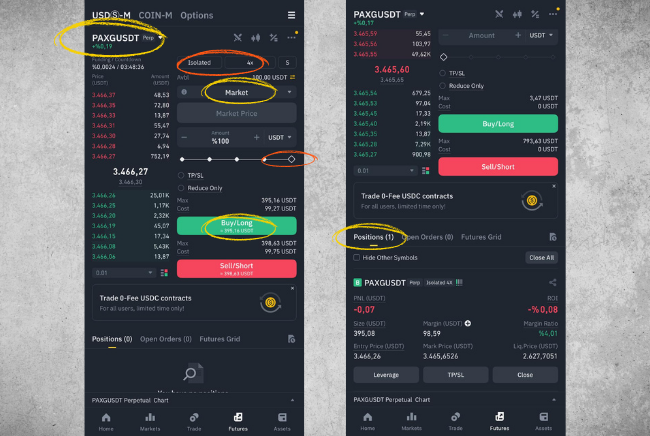

Click on Futures at the bottom right of the main page.

Set the pair to PAXG/USDT.

Open the trade in ISOLATED mode, meaning you only use the 100 $ transferred to your Futures wallet.

Set the leverage to 4x; high leverage is very risky.

Choose MARKET as the order type, so the trade opens at the current price.

Set the amount to 100%, using all of your 100 $.

Then click LONG and your position will be opened.

As you can see, Positions shows 1.

Our liquidation level is displayed at the bottom right as 2189 $. If PAXG drops to 2189 $, our 100 $ will be lost.

We used 4x leverage, which means a 25% drop in price wipes out the position.

If you expect PAXG’s price to fall, click SHORT instead of LONG, and you will profit as PAXG decreases.

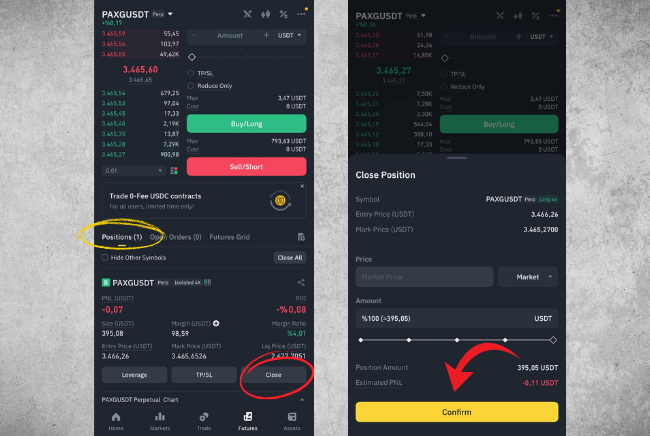

To exit the position, click CLOSE and then CONFIRM to close it.

My explanations are not investment advice; they reflect my personal opinions.

Futures trading carries high risk; depending on the leverage used, market volatility, and position size, investors can lose their entire capital in a short time, and unexpected price movements can lead to significant losses.

English

English