How to Use Stop Loss and Take Profit on Binance Futures?

In our previous articles, we covered the following topics related to futures trading:

- What is Binance Futures?

- How to transfer funds to Binance Futures?

- What is Long-Short?

- What are Cross and Isolated margin modes?

- How to avoid liquidation on Binance Futures?

- What is the funding fee?

We explained these step by step.

In this article, we’ll cover: How to use Stop Loss and Take Profit on Binance Futures?

Let’s dive into the details

Binance Futures allows users to place Take Profit (TP) and Stop Loss (SL) orders simultaneously to better manage their risk-reward ratio.

Risk management techniques like Take Profit and Stop Loss orders can help protect your trading account from major losses.

The most helpful thing to prevent major losses is learning the right time to enter and exit a trade, and when to leave a losing position. By reducing your losses, you can protect your trading account from a significant hit.

By setting Take Profit (TP) and Stop Loss (SL) orders, you can minimize risks and keep your emotions under control. This way, you increase the chances of reducing stress and protecting your decision-making process from emotional influences throughout your trading journey.

To summarize

Take Profit (TP) and Stop Loss (SL) orders on Binance Futures allow traders to manage their positions automatically.

- Stop Loss: When the price reaches your set loss level, the position closes automatically, preventing major losses.

- Take Profit: When the price hits your target profit level, the position closes automatically, securing your gains.

These orders mean you don’t have to constantly monitor the market, reduce emotional decisions, strengthen risk management, and protect against sudden price swings. This way, you can limit losses and lock in profits. They are fundamental components of a successful futures trading strategy.

How to Place Take Profit and Stop Loss Orders on Binance Futures?

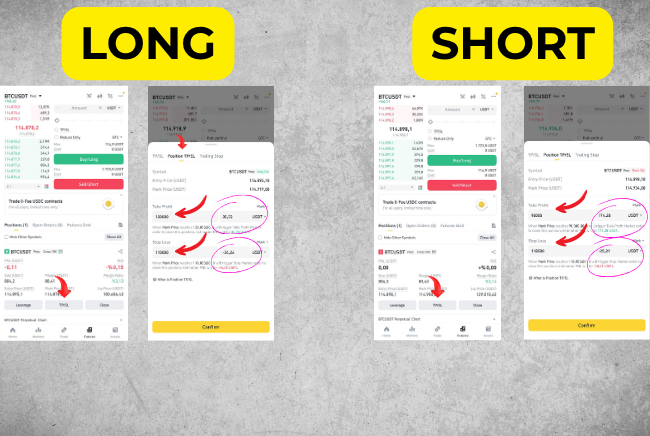

For example, I opened a $80 long position on Bitcoin with 10x leverage. To set TP/SL, I clicked on “Position TP/SL”.

I entered 120,000 in the Take Profit field,

and 110,000 in the Stop Loss field.

I placed both orders and clicked “Confirm”.

If Bitcoin rises to 120,000, the position will automatically close with a profit of around $35.

If Bitcoin drops to 110,000, the position will close with a $25 loss.

This way, I’ll prevent a larger loss.

For example, I opened a $80 short position on Bitcoin with 10x leverage. Since I opened a short position, I’ll profit if Bitcoin drops, and I’ll lose if it rises. To set the TP/SL, I clicked on the “Position TP/SL” option.

I entered 90,000 in the Take Profit field,

and 118,500 in the Stop Loss field.

I placed both orders and clicked the “Confirm” button.

If the price of Bitcoin drops to 90,000, the position will automatically close with a profit of approximately $175.

If Bitcoin rises to 118,500, the position will close with a $25 loss.

This way, I’ll prevent a larger loss.

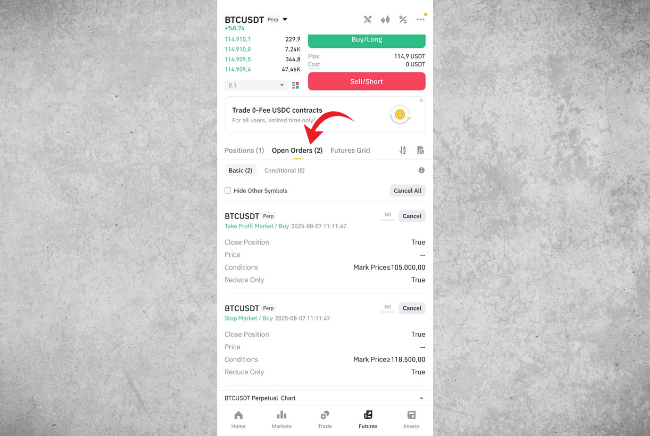

The orders I placed appear in the Open Orders section. If I want, I can cancel them by clicking Cancel.

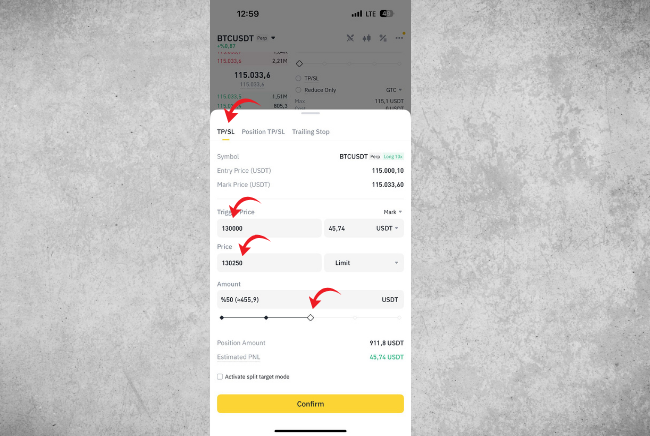

There is also a TP/SL section, which you can use to partially close your position.

For example, I opened a long position on Bitcoin at $115,000.

If Bitcoin rises to $130,000, I set it to close 50% of the position at $130,250.

If the target is reached, half of the position will be automatically closed.

English

English