How to Open a Futures Long Position on Coins with ETF Applications?

What is an ETF, and what does an ETF application mean for coins?

An ETF is an investment product that tracks the value of an asset and trades on a stock exchange. For cryptocurrencies, an ETF application indicates that institutions want to officially launch an ETF for that coin. This usually brings more attention and visibility to the coin.

Coins with ETF Applications Bitcoin (BTC), Ethereum (ETH) – approved ones

Here are the altcoins with ETF applications:

$SOL (Solana)

$DOGE (Dogecoin)

$ADA (Cardano)

$TRUMP (TrumpCoin)

$AVAX (Avalanche)

$APT (Aptos)

$DOT (Polkadot)

$HYPE (Hyperliquid)

$XRP (Ripple)

$BONK (Bonk)

$BNB (Binance Coin)

$AXL (Axelar)

$PENGU (Pudgy Penguins)

$SUI (Sui)

$LTC (Litecoin)

$HBAR (Hedera Hashgraph)

How to Open a Long Position on Coins with ETF Applications?

We use Binance, the world’s largest cryptocurrency exchange, for leveraged trading.

Now, we will choose an example coin.

Let’s take Avalanche (AVAX); we will open a long position for this coin in the futures market.

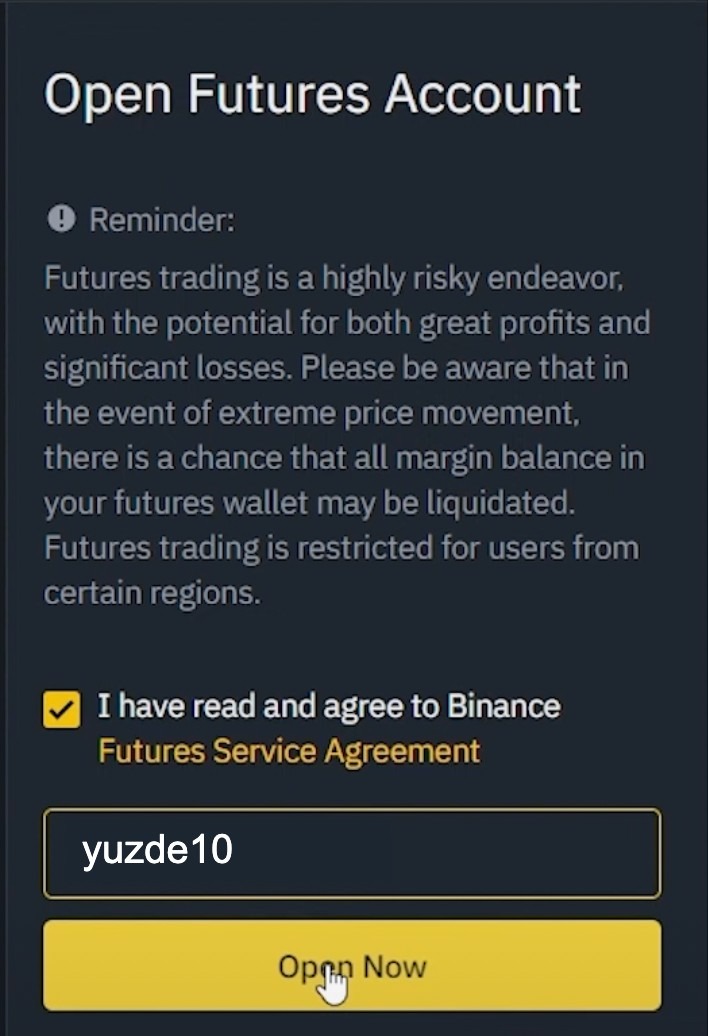

Futures trading offers high profit potential but also carries significant risks. Using leverage can amplify gains but also magnify losses. If your position reaches the liquidation level, your entire collateral can be lost. Additionally, market volatility and costs such as funding fees increase the risks. Therefore, risk management and cautious trading are crucial.

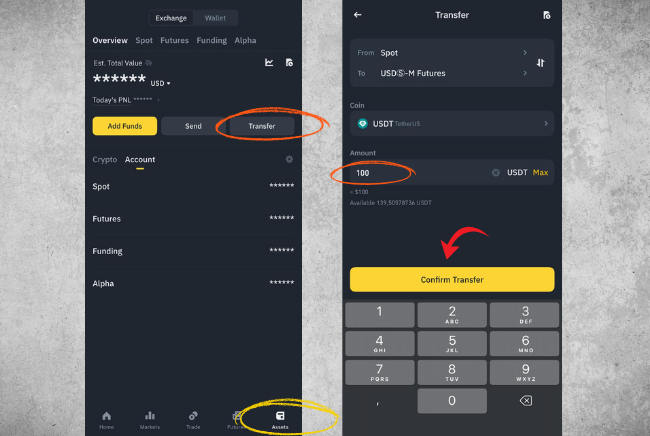

First, we need to transfer our funds from the spot account to the futures account on Binance.

Log in to Binance, click on the Assets tab, then select Transfer. Enter the amount you want to deposit and click Confirm Transfer.

Our funds are instantly transferred to Futures

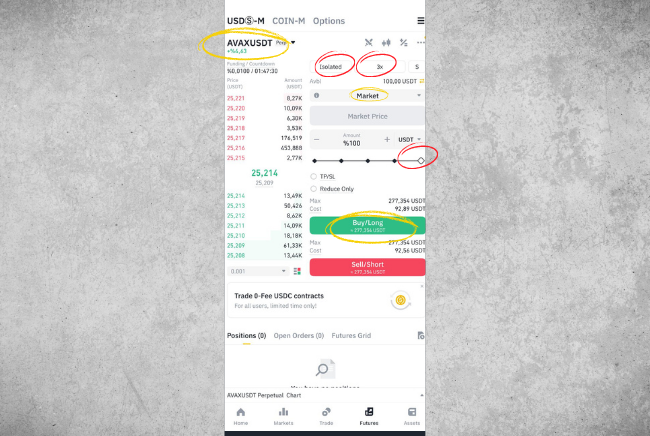

Select the AVAXUSDT pair. If you want to choose another coin, click on the coin and type the one you want in the search bar.

Select ISOLATED mode. For beginners, we recommend isolated mode, which means you can only open a position with the amount you’ve deposited. If it were CROSS, you could add more funds later.

Enter the leverage amount. We never recommend high leverage because the crypto market is very risky.

Choose a Market order, which means entering the trade at the current price.

Enter the amount — for example, we used $100. You can trade with $100 or any smaller amount.

Then, click the Long button, and your long position will be opened.

What I’ve explained is not financial advice, just my personal opinion. Trading in the crypto and futures markets carries high risks, and there is always a possibility of losing the money you invest.

If we want to close the position, we click the Close button and then Confirm.

English

English