How to Lower the Binance Futures Liquidation Price

One of the most important things Binance Futures users need to pay attention to is the liquidation price. An incorrect position size or high leverage can wipe out your account. However, it is possible to manage and even reset this level when necessary. In this article, I will show you how to lower the liquidation price, and in the next one, I will explain how to reset it completely.

In Binance Futures, the liquidation price is the price level at which your open position will be automatically closed by the system. In other words, when the market price reaches this level, your margin (collateral) becomes insufficient and your entire position is forcibly closed by Binance.

The difference from spot trading is this: When you buy a coin on spot, even if the price drops by 80–90%, you still hold the same coin. However, in futures trading, once the price hits the liquidation level, you can lose your entire balance.

In short, the liquidation price is the “burn point” of your position. Knowing this level well is one of the most important steps in risk management when trading futures.

Binance Futures offers investors the potential for significant profits due to high leverage and the volatile nature of the crypto market, but it is an extremely risky investment tool, as improper position management or insufficient risk control can lead to losing your entire balance in a very short time.

Common Mistakes in Binance Futures

Using excessive leverage

Investors often use 50x or higher leverage in pursuit of high profits. Even small price movements can liquidate the position.

Not setting stop-loss

Failing to define a risk level when opening a position. Sudden market drops can result in losing your entire balance.

Opening a single position with the entire balance

Risking your entire balance in cross margin mode. A single wrong move can wipe out your entire account.

Ignoring market trends

Opening trades based only on “price will go up/down” logic. Neglecting trend analysis and technical indicators increases potential losses.

Making emotional decisions

Managing positions out of panic or greed. Trading without a plan and making rushed decisions can amplify losses.

Now, let’s lower our liquidation price with an example

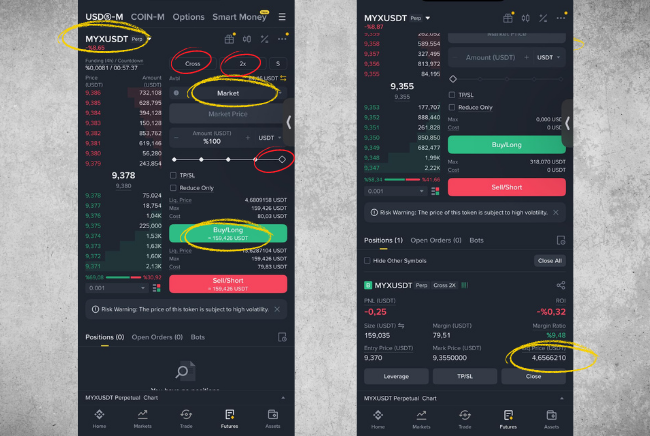

To lower our liquidation price, we need to use cross mode. For example, let’s open a long position on MYX coin.

Select the MYX/USDT trading pair.

Choose cross mode.

Set the leverage.

Select a market order.

Enter the amount.

Click on the long option.

The position is opened.

As you can see, the liquidation price is shown as 4.65.

This means that if the price drops from our entry level of $9 to $4.65, our entire balance in this trade will be wiped out.

Let’s assume the price is about to reach this level, so we want to lower the liquidation price. So, what should we do?

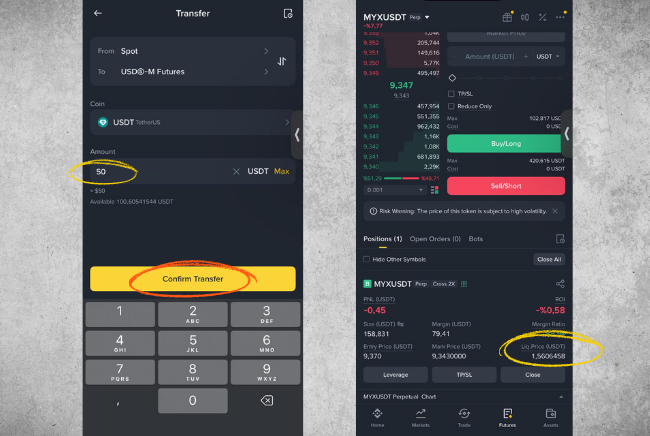

All we need to do is deposit a little more funds into our Binance Futures account.

I’m depositing an additional $50, and as you can see, your liquidation price has dropped to $1.56.

This is how I demonstrated lowering the liquidation price. As I mentioned, to do this, we need to open a position in cross mode. In the next article, I will show how to completely reset the liquidation price.

English

English