Times to Avoid Trading in the Futures Market

Low Liquidity Hours

At certain times, there are fewer traders in the market, so prices can change quickly and unexpectedly.

Example: 02:00–06:00 UTC, early hours on weekends. Avoid making large trades during these hours.

Major Economic News

Big economic events, such as speeches by the FED Chair, the FED interest rate decision, non-farm payroll data, unemployment claims, and inflation reports, can suddenly affect the market.

During these events, prices can be volatile and move unpredictably.

Stock Market Opening and Closing Hours

Price volatility increases during the opening and closing hours of the US, European, and Asian stock markets. Large positions can be risky during these periods due to higher market fluctuations.

US: 14:30 – 21:00 UTC

Europe: 08:00 – 16:30 UTC

Asia: 03:00 – 11:00 UTC

Beginning and End of the Week

On Mondays, volatility can increase as the weekly trend starts to form.

On Fridays, prices can be more volatile due to lower liquidity heading into the weekend.

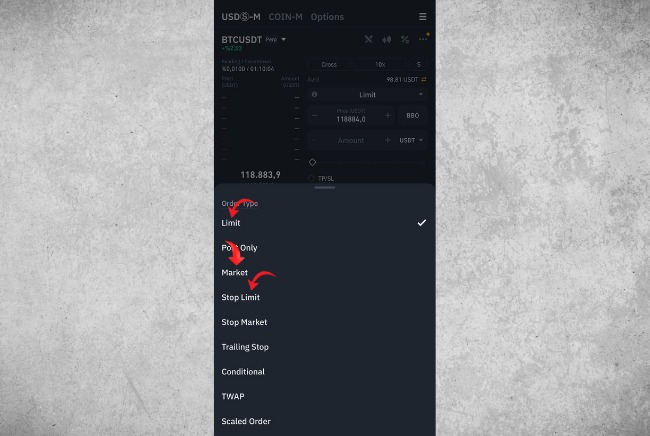

Funding Fee and Contract Rollover Times

Funding Fee occurs at 00:00, 08:00, and 16:00 UTC.

Opening positions just before these times can increase additional costs and liquidation risk.

Sudden News and Social Media Effects

Regulatory announcements or unexpected market moves can quickly change prices.

Opening positions during these times is risky; using stop-loss orders is highly recommended.

Before New Contract or Token Listings

Right before a new contract or token is listed, prices can move very quickly.

Opening positions at this time is risky.

When the price approaches major technical resistance and support levels, sudden movements can occur. The risk of liquidation increases at these levels. It is important to perform technical analysis and apply risk management before opening a position.

During periods when the market is extremely down or up, investors may act impulsively due to FOMO (fear of missing out), causing rapid price fluctuations. Opening positions at these times is risky.

Opening positions during these times is risky and can increase losses; risk management and careful analysis are always essential.

English

English