Getting Started with Leveraged Trading: Open Your First Position

In crypto, futures trading is a type of contract where you predict whether a coin’s future price will go long or short, multiplying your profit or loss by the chosen leverage.

Long Position: A position you open when you expect the price to go up.

Short Position: A position you open when you expect the price to go down. In other words, you open a short when you think, “This coin will fall, and I will profit from the decline.”

Summary: Long = profit from price increase, Short = profit from price decrease.

For example, you deposit $100 into futures trading and expect Bitcoin’s price to rise, so you open a long position. With a 5x leverage, your $100 controls a $500 position. If Bitcoin’s price increases by 10%, you earn 10% of $500, which is $50. Conversely, if the price drops by 10% from your entry point, you would lose $50.

For example, you deposit $50 into futures trading and use 4x leverage, making your position size $50 × 4 = $200. If the coin’s price rises 25% from your entry point, you would earn $50. However, if the price drops 25%, you could lose your entire $50 investment.

Of course, there are many ways to reduce risk; you can find them in our other posts.

Differences Between Spot and Futures:

Ownership: In spot trading, you buy actual cryptocurrencies and store them in your wallet; in futures trading, you hold contracts based on price movements, not the actual coins.

Trading Process: Spot trades are executed immediately, and assets are transferred to your account; futures trades are conducted through contracts and may have specific expiration dates.

Leverage: Spot trading usually has little or no leverage; futures trading allows leverage from 1x up to 125x.

Position Direction: In spot trading, you can only go long (buy); in futures trading, you can take both long (up) and short (down) positions.

Risk Level: Spot trading carries lower risk (you can only lose what you invest); futures trading carries higher risk due to leverage and the possibility of liquidation.

Holding Period: Spot trading allows long-term holding; futures trading is generally used for short- to medium-term positions.

Costs: Spot trading usually has lower fees; futures trading incurs higher costs due to trading fees and funding rates.

Why do we use Binance for futures trading?

Security: Binance is one of the largest and most reliable crypto exchanges in the world, using advanced security systems to protect user funds.

Liquidity: High trading volume allows positions to be opened and closed quickly with minimal slippage.

Leverage Options: Binance offers different leverage levels, allowing flexible application of trading strategies.

Advanced Tools and Charts: Provides advanced charts, indicators, and tools for technical analysis.

Ease of Use and Mobile Friendly: Positions can be easily opened and managed via web or mobile app.

Low Fees and Discounts: Competitive trading fees and various discounts reduce trading costs.

Multiple Supported Cryptos: Enables futures trading on Bitcoin, Ethereum, and many altcoins.

Extra Features: Risk management tools like stop-loss, take-profit, and automated orders are available.

Risks of Futures Trading

High Leverage Risk: Leverage can amplify losses even with small price movements.

Market Volatility: Crypto markets are highly volatile; prices can rise or fall suddenly.

Liquidity Risk: In coins with low trading volume, you may not be able to close positions at your desired price.

Psychological Risk: Sudden price changes can cause panic selling or impulsive decisions.

Funding Fees: Keeping positions open for a long time may incur additional costs.

Margin Call / Liquidation: If losses reach a certain level, the position is automatically closed and the invested capital can be lost.

Binance Futures: How to Open Your First Position

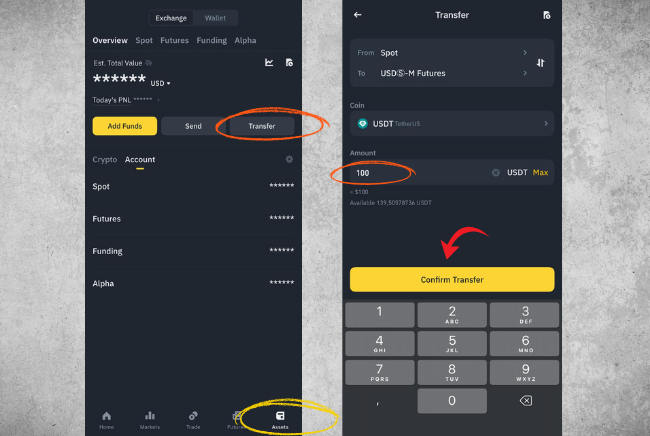

First, log in to Binance and transfer funds from your Spot account to your Futures account. To do this:

Click on Assets.

Click Transfer.

Enter the amount you want to transfer.

Click Confirm Transfer.

As you can see, our funds appear under AVBL.

Now, we will open a position with $100.

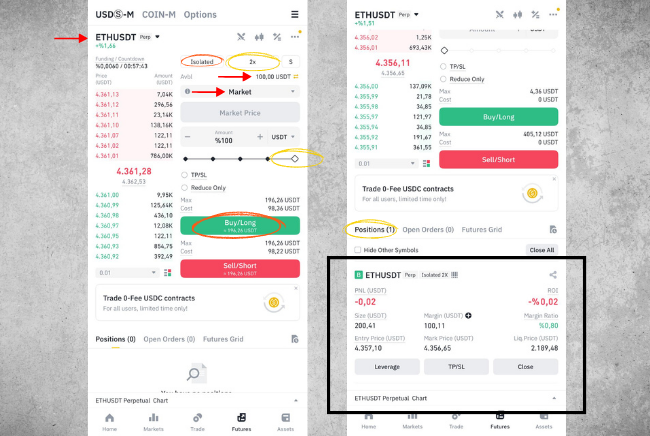

I’m selecting Ethereum; you can click on ETH/USDT and search for any coin you want.

Since this is the first trade, I’m setting the leverage to 2x.

I’m opening the trade in Isolated mode; for beginners, I recommend Isolated.

I set the amount to 100%, meaning I’m using all of my $100 for this position.

I select the Market order option, which opens the trade immediately.

Since I expect Ethereum’s price to increase, I click Long and the position is opened.

After opening the trade, as you can see, it shows 1 under Positions. From here, I can see the details of my position.

As you can see, I opened a trade worth $200.

The PNL section shows the profit or loss; I entered the trade with $100.

The ROI section shows the profit or loss percentage.

Entry Price shows our entry level; we entered the position at $4357.

Mark Price indicates the current market price.

Finally, the Liq Price shows $2189, which means if Ethereum drops to $2189, my entire $100 will be lost.

This is how you can open your first trade. If you want to close the position, you can click Close.

Futures trading offers high profit potential but also carries high risks.

Leverage risk means even small price movements can lead to large gains or significant losses. Higher leverage increases volatility and the risk of losing your entire investment.

Liquidation risk occurs if the position reaches the liquidation price, which can result in losing the entire margin. The liquidation price depends on the entry price and leverage used.

Market volatility is high in the crypto market; sudden price swings can quickly turn a position into a loss.

Order and liquidity risk arises when using a market order, as rapid price changes may cause the trade to execute at an unexpected price. Low liquidity coins can see large trades impact the price quickly.

Psychological risk comes from panic selling or hasty decisions during profits or losses, which can disrupt a disciplined strategy.

Financial risks include funding fees and commissions, which can increase costs, especially for long-term positions. Poor position management can lead to significant losses in a short time.

In short, futures offer high return opportunities, but there is always a risk of losing your entire margin. Using low leverage, risk management, and a disciplined strategy is essential.

What I’ve explained is not investment advice; it is my personal opinion.

English

English