How Much Could You Have Earned with a Monthly Long Strategy on Ethereum Futures?

When it comes to cryptocurrency, the first things that come to mind are Bitcoin and altcoins. The largest altcoin, Ethereum, recently dropped to $1,385. But then it surged so dramatically that it reached its all-time high of $4,956, shaking the markets.

What if you had opened a long position on Ethereum every month? In futures trading, most investors act based on instant decisions, but very few question how a consistent and disciplined strategy would perform in the long run. In this article, we’ll test the “Monthly Long Strategy on Ethereum Futures” using historical data to see whether such an approach would truly be profitable or just a major risk.

Futures trading can offer investors the opportunity for high profits in a short time; however, due to the use of leverage, positions can quickly lose value and lead to significant financial losses. Therefore, risk management and strategy planning are critical when trading futures.

Now let’s look at Ethereum’s month-by-month performance in 2025.

JANUARY: -1%

FEBRUARY: -32%

MARCH: -19%

APRIL: -1%

MAY: 41%

JUNE: -2%

JULY: 49%

AUGUST: 23%

In total, it fell for 5 months and rose for 3 months.

For example, if we open a long position on Ethereum with $100 at the beginning of each month and close the position at the end of the month, what would happen?

$100 with 2x leverage:

JANUARY: -$2

FEBRUARY: -$64

MARCH: -$38

APRIL: -$2

MAY: $82

JUNE: -$4

JULY: $98

AUGUST: $46

= $116

A person who entered with $100 using 2x leverage would have made $116 profit by the end of August, turning their $100 into $216.

$100 with 3x leverage:

JANUARY: -$3

FEBRUARY: -$96

MARCH: -$57

APRIL: -$3

MAY: $123

JUNE: -$6

JULY: $147

AUGUST: $69

= $174

A person who entered with $100 using 3x leverage made a profit of $174 by the end of August, increasing their initial $100 to $274.

$100 with 5x leverage:

JANUARY: -$5

FEBRUARY: Liquidated

MARCH: -$95

APRIL: -$5

MAY: $205

JUNE: -$10

JULY: $245

AUGUST: $115

= $340

A person who entered with $100 using 5x leverage ended August with a $340 profit, turning their initial $100 into $440.

The risks of using high leverage can be quite serious. Here are the details:

Rapid losses: The higher the leverage, the greater the impact of price movements. Even a small price drop can wipe out your entire invested capital. For example, with $100 at 5x leverage, a 20% price drop could completely erase your $100.

Liquidation risk: Leveraged positions are automatically closed if your equity falls below a certain level (liquidation). In this case, you can lose your entire investment.

Psychological pressure: High-leverage trades are exposed to rapid price swings, which can lead to panic selling or hasty decisions.

Extra costs: Leveraged positions may incur higher funding fees and commissions, which can reduce profits or increase losses.

Market volatility: Highly volatile markets, like crypto, are riskier for high-leverage traders. Unexpected news or sudden price movements can quickly close positions.

For this reason, beginners should keep their leverage at a minimum.

What I shared is not investment advice; these are my personal opinions.

In conclusion, a person who opened a long position on Ethereum every month has made a profit over the 8 months.

So, how do you open a long position on Ethereum?

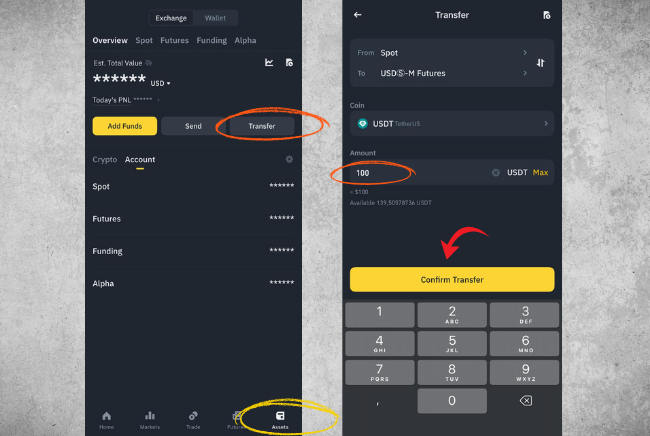

To open a long position on Ethereum, you first need to deposit funds into your Futures account:

Go to the Assets section.

Click on Transfer.

Enter the amount you want to deposit.

Click Confirm Transfer to complete the process.

2222222222222

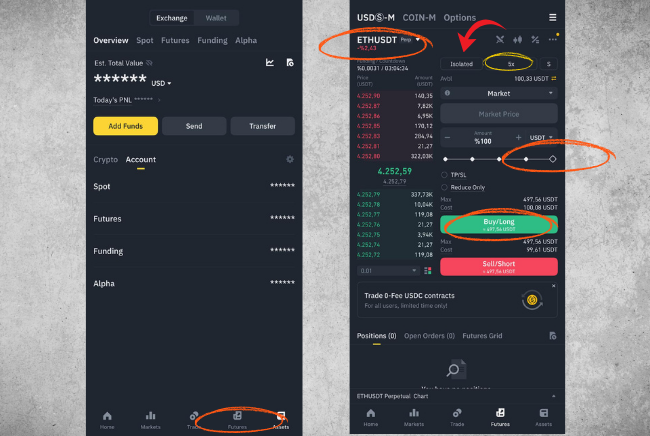

To open a long position on Ethereum:

Go to the Futures section.

Select the ETH/USDT pair.

Enter the leverage amount.

Choose Isolated mode (suitable for beginners).

Select Market as the order type (enters the trade immediately).

Enter the amount.

Click Long to open the position.

English

English