How to Open a Long Position on Ethereum?

Ethereum has recently delivered an impressive performance. Around four months ago, ETH dropped to $1,385, while the $881 level was considered a strong support. At that time, many investors believed the price would decline all the way to that level.

So, did it really crash? Absolutely not. On the contrary, Ethereum surged from that point and reached $4,788 — delivering nearly a 4x return in a surprisingly short period of time.

It’s now only 15% away from its all-time high of $4,868.

So, what will we cover in this article? I’ll walk you through it step by step.

What are Ethereum futures?

Ethereum futures allow you to trade based on predictions of its future price rather than buying ETH directly. In other words, these trades focus on the value Ethereum might reach, not its current price.

In the spot market, if you think Ethereum will rise, you buy; if you believe it will fall, you sell — all based on the current price. In futures trading, however, there’s no need to physically buy or sell Ethereum. You can open positions anticipating the price will go up or down, and keep these positions open for a set period or indefinitely.

WARNING: Futures trading offers high profit potential, but due to rapid price fluctuations, it carries the risk of losing the entire invested capital, requiring a careful and informed approach.

For futures trading, we will be using Binance, the world’s largest cryptocurrency exchange.

What is leverage?

For example, we have $100 and can apply any leverage we want. Let’s say we use 2x leverage. If the price increases by 5% from our entry point, we earn 2×5% = 10%, so our $100 becomes $110.

If the price rises by 10%, with 2x leverage we gain 20%, making our $100 become $120.

If the price goes up by 50%, 50×2% = 100% gain, so our capital grows to $200.

If the price doubles (100% increase), we achieve 200% profit, turning $100 into $400.

The maximum leverage available varies for each cryptocurrency. For Ethereum, you can open positions with up to 150x leverage.

So, what happens if the price falls instead of rising from the level where we opened a long position?

For example, we have $500 and open a long position on Ethereum with 5x leverage. If the price falls 5% from our entry point, we incur a 5×5% = 25% loss, reducing our $500 to $375.

If the price drops 10%, we take a 5×10% = 50% loss, leaving us with $250.

If the price falls 20%, we suffer a 5×20% = 100% loss, meaning we get liquidated and lose all our capital.

How to trade Ethereum futures?

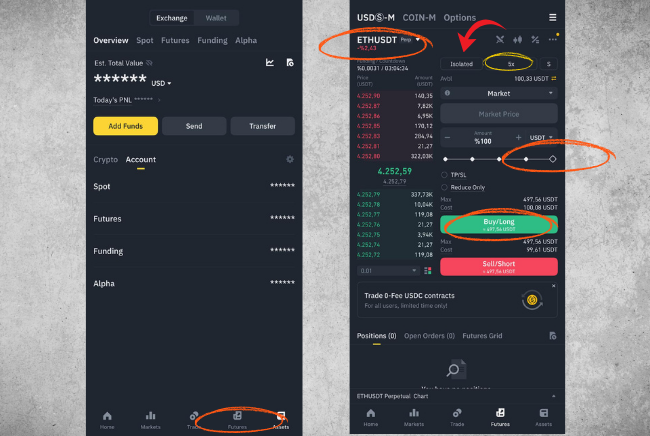

Log in to Binance. First, we need to transfer funds from our spot account to our futures account.

Click on the ‘Assets’ section, then select ‘Transfer’ and enter the desired amount.

The funds are transferred instantly.

Click on the ‘Futures’ tab.

Select the ETH/USDT pair from the top left.

Open the position in Isolated mode; we recommend isolated mode for beginners.

Set the leverage (I’m choosing 5x leverage).

Enter the amount.

Click on the ‘Buy/Long’ button.

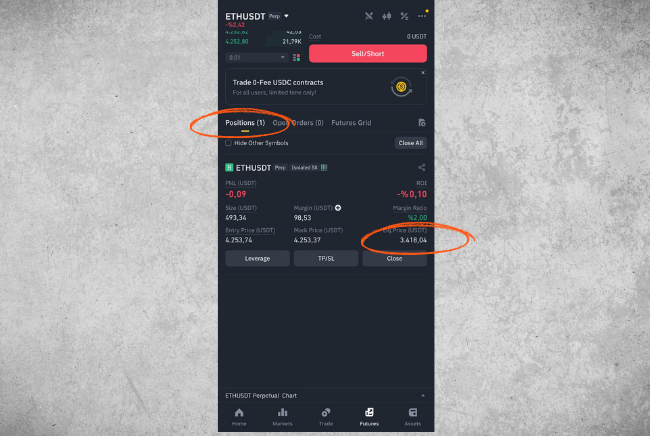

Look, there’s a ‘1’ in the ‘Positions’ section. We can track our position from here. As you can see, if ETH drops to $3,418, the position will be liquidated and all our funds will be gone — our $500 becomes $0.

We opened the trade using a market order.

Market order: Executes immediately against existing open limit orders.

If you want to learn other order types and futures trading step by step, you can follow our other articles.

This is not investment advice, it only reflects my personal opinion.

English

English