Opening a Long Position on Bitcoin: A Simple Guide for Beginners

Let’s start by explaining what long and short positions mean.

Long Position: This is a buy position you open when you expect the market to rise. You make a profit if prices go up and take a loss if they go down. If you use leverage, both your profits and losses are multiplied according to the leverage ratio.

Short Position: This is a sell position you open when you expect the market to fall. You make a profit if prices go down and take a loss if they go up. In leveraged trading, your gains increase if the price moves in your favor, but your losses also grow if it moves against you.

For example, you have $100 and want to open a long position with it. You select the coin and open a long position with 10x leverage. If the coin rises by 1% from your entry price, you would earn 10 x 1% = $10 profit.

If the coin rises by 5%, you would earn 10 x 5% = $50 profit.

If it rises by 10%, you would earn 10 x 10% = $100 profit.

If it rises by 20%, you would earn 10 x 20% = $200 profit.

If it rises by 50%, you would earn 10 x 50% = $500 profit.

In other words, your profit is calculated by multiplying the leverage by the percentage increase in price.

We opened a long position because we expected the price to rise, but what happens if it falls from our entry point?

For example, we opened a long position with $100 using 5x leverage. If the coin drops by 2%, we would incur 5 x 2% = 10% loss, and our $100 would decrease to $90.

If the coin drops by 5%, we would incur 5 x 5% = 25% loss, and our $100 would decrease to $75.

If it drops by 10%, we would incur 5 x 10% = 50% loss, and our $100 would decrease to $50.

But what if it drops by 20%? In that case, 5 x 20% = 100% loss, and all the funds in our position would be gone, leaving a balance of $0.

Of course, to prevent losing all of our funds, we can open a position in cross mode to lower our liquidation level. However, this also carries risks, and I will cover this topic in another article.

Futures trading allows you to achieve significant profits with a small capital thanks to leverage; however, it also carries the risk of substantial losses if the market moves against you, making careful and informed trading essential

What I have shared is not investment advice; these are my personal opinions.

How to Open a Long Position on Bitcoin?

For this, we will use Binance, the world’s largest and most reliable cryptocurrency exchange.

Now, let’s explain it step by step.

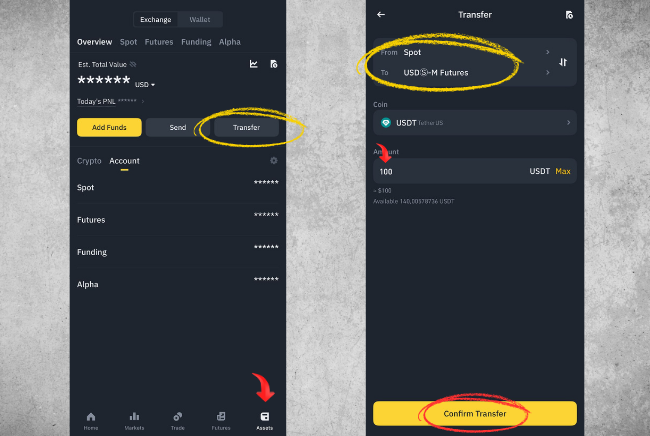

First, we need to transfer funds from our spot account to our futures account.

Log in to Binance, go to Assets, and click on Transfer.

Select Spot at the top and Futures at the bottom, enter the amount (for example, $100), and click Confirm.

Next, click on Futures.

As you can see, $100 has been transferred to our futures account.

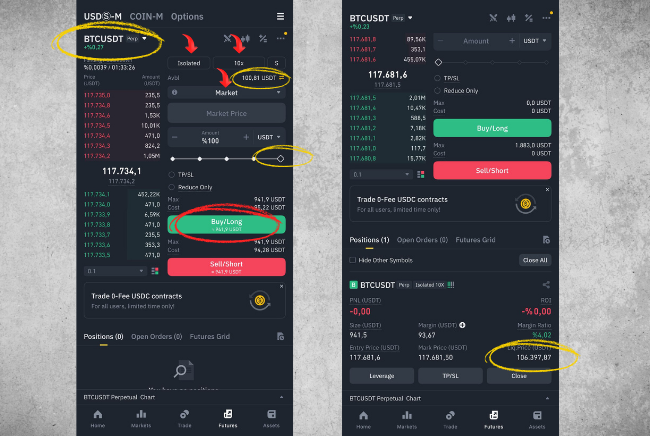

First, we select the coin we want, in this case BTC, and set the leverage (I set it to 10x).

I’m opening the trade in Isolated mode, meaning only $100 is at risk. I will also show the difference with Cross mode.

We choose a Market order to open the trade; once we enter the amount and click Long, the position is opened.

As you can see, we have successfully opened the position.

In an Isolated position, our liquidation price is $106,397. This means if Bitcoin drops to $106,397, we will lose the funds we invested.

However, if we open a position in Cross mode instead of Isolated, we can add funds to the account and lower our liquidation price. But if the price drops further, our losses will also increase. Therefore, if you are a beginner, it is more advantageous to trade in Isolated mode.

This is how we can open a long position on Bitcoin. However, remember that leveraged trading offers high profit potential but also carries the risk of significant losses if the market moves against you. It is always important to trade carefully and responsibly.

English

English