10 Big Mistakes That Make You Lose Money in Binance Futures (And How to Fix Them)

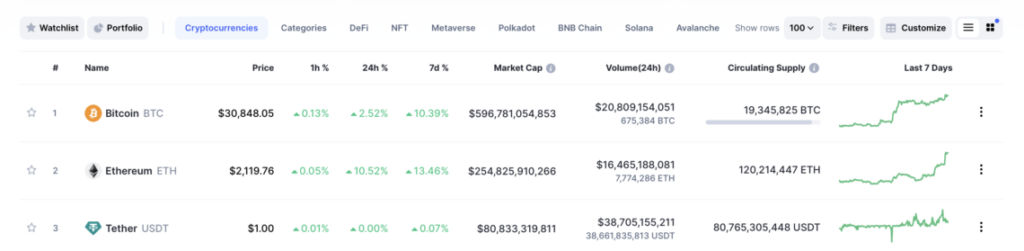

The cryptocurrency markets continue to attract investors with their high profit potential. However, especially on leveraged trading platforms like Binance Futures, the promise of high returns comes with significant risks. Many traders suffer heavy losses due to small mistakes made without fully understanding these risks.

In this article, we will examine the 10 biggest mistakes commonly made on Binance Futures and how to avoid them in detail. Our goal is to help you trade more consciously and control your risks better. If you want to succeed in futures trading and protect your capital, this guide is made for you!

Using High Leverage

Mistake: Using extreme leverage like 50x–125x can lead to liquidation even with small price moves.

Solution: For beginners, 2x–5x leverage is enough. Test your strategy with low leverage first.

Not Using a Stop Loss

Mistake: Opening trades without a stop loss, hoping “the price will come back.”

Solution: Always set a stop loss based on the maximum amount you are willing to risk.

Going All-In on a Single Trade

Mistake: Using your entire capital in one trade leaves no room for recovery.

Solution: Apply the 1–5% risk rule to split your capital.

Trading Without a Plan or Strategy

Mistake: Entering trades based only on “gut feelings.”

Solution: Combine technical analysis, fundamental analysis, and risk management before opening positions.

Trading Without Checking Market News

Mistake: Opening trades without knowing about upcoming news or economic data releases.

Solution: Check the economic calendar and be prepared for volatility.

Watching the Chart Non-Stop

Mistake: Constantly monitoring the chart and closing trades out of panic.

Solution: Trust your trading plan and predefine your stop and target levels.

Overtrading

Mistake: Constantly opening and closing trades based on emotions.

Solution: Set a daily trade limit and stick to it.

Emotional Trading

Mistake: Taking “revenge trades” after a loss.

Solution: Take a break after losing trades and rely on data, not emotions.

Ignoring Funding Fees

Mistake: Forgetting about the cost of funding fees in long-term positions.

Solution: Plan your trade duration and be aware of funding fee times.

Wrong Position Sizing

Mistake: Not adjusting your position size based on market volatility.

Solution: Reduce position size in high volatility and increase slightly in low volatility.

English

English