Order Types on Binance Futures

On Binance Futures, there are three main order types that investors can choose from to trade wisely.

1️ Limit Order

2️ Market Order

3️ Stop-Limit Order

Market: Execute a trade immediately at the current market price.

Limit: Execute a trade when the specified price is reached.

Stop-Limit: Place a limit order when the specified trigger price is reached.

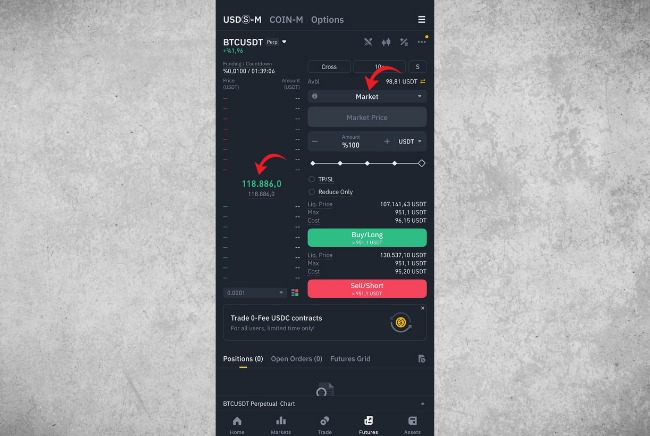

Market Order

A market order allows you to execute a trade instantly at the current market price.

For example, if the price of Bitcoin is currently 118,886 USD and you select a “Market” order to buy, your position will be opened immediately at that price. The purpose of a market order is to enter or exit quickly.

Its advantage is speed; the disadvantage is the risk of price slippage.

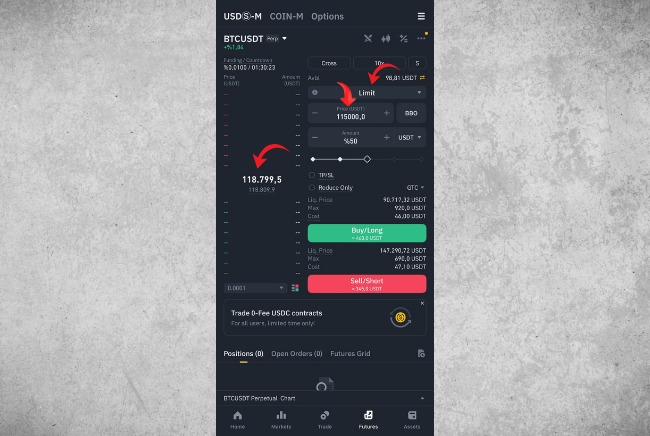

Limit Order

A limit order is executed only when the price reaches the level you set.

For example, if Bitcoin is at 118,799 USD and you believe that 115,000 USD is a support level, you can place a limit order at that level. When the price reaches 115,000 USD, your order is triggered and the position is opened.

The advantage is that you can buy or sell at your desired price; the disadvantage is that if the price never reaches that level, the order will not be executed.

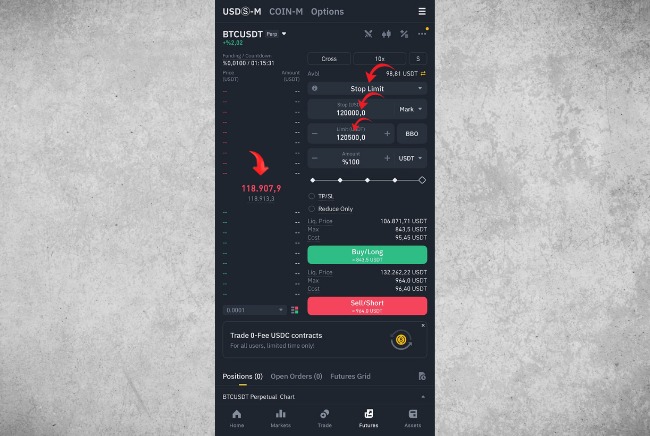

Stop Limit Order

A stop limit order is essentially a two-step order:

1.Stop price: The price at which the order is triggered.

2.Limit price: The highest (or lowest) price at which the order will be executed.

Imagine Bitcoin is currently at 118,907 USD.

You say: “If the price reaches 120,000 USD, I want to buy, but I don’t want to pay more than 120,500 USD.”

Stop price: 120,000 (order is triggered)

Limit price: 120,500 (purchase will be made up to this price)

The advantage is that even if the price moves very quickly, it will not execute above your specified limit.

It is generally used to stop losses or secure profits.

English

English