“What Is the Difference Between Binance Futures Cross and Isolated – Which One Is Better?”

Binance friends, I’m here with the third article of our Futures usage series. In this article, we need to talk about whether we should use “Cross” or “Isolated” on Binance Futures. I will explain the difference between these two concepts and what each one means in detail. Let’s get into the article without wasting any time.

Instead of explaining all futures concepts in a single article, we cover each concept in detail in separate articles. In this article, we will look at the concepts of isolated and cross.

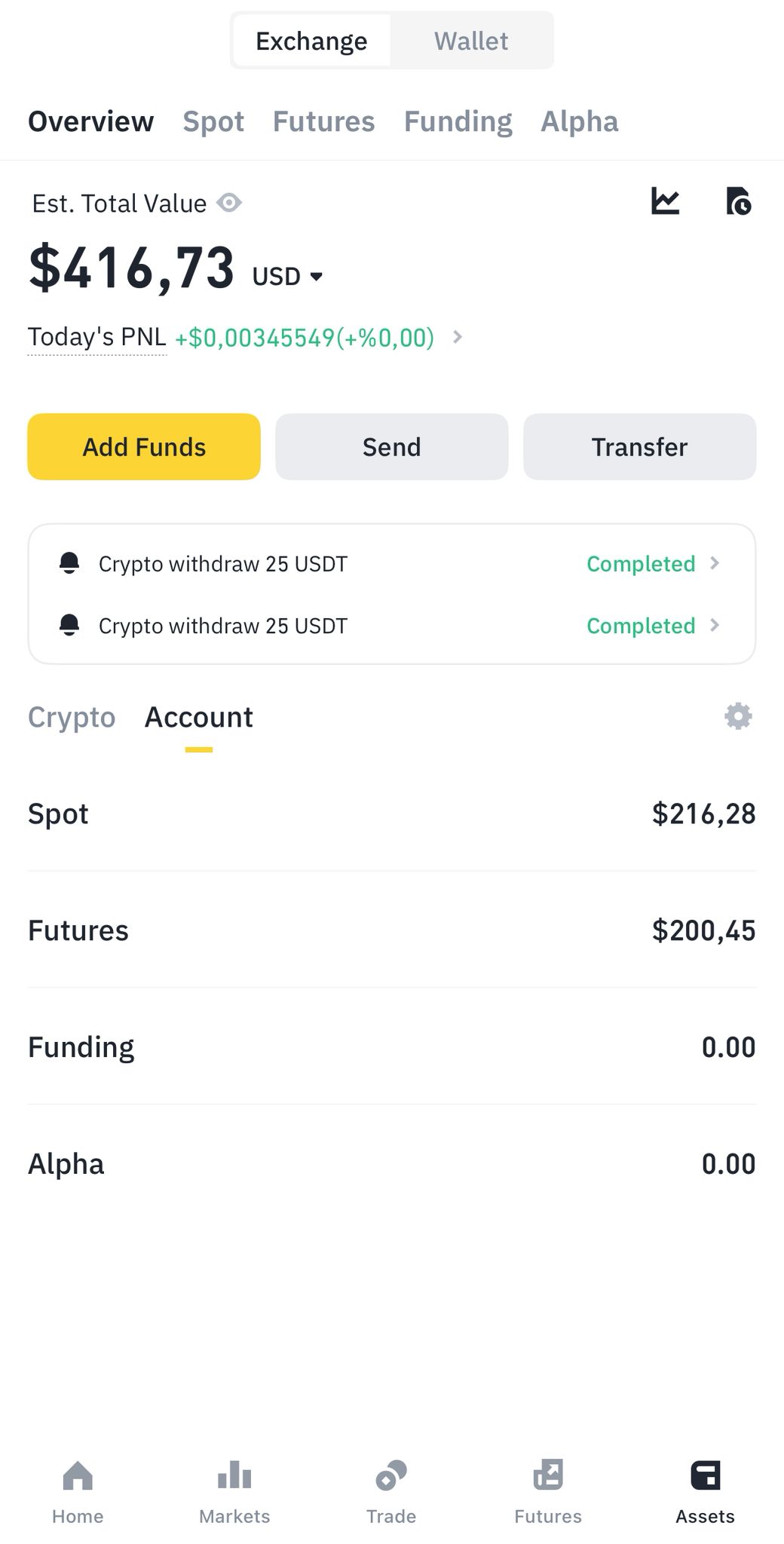

Let’s first take a look at my total balance. Right now, I have $416 in my account — $216 in my spot wallet and $200 in futures. The first thing we need to understand is this: even if all my money is in futures, the funds in my spot wallet won’t be lost. In other words, no kind of debt is created in my futures account.

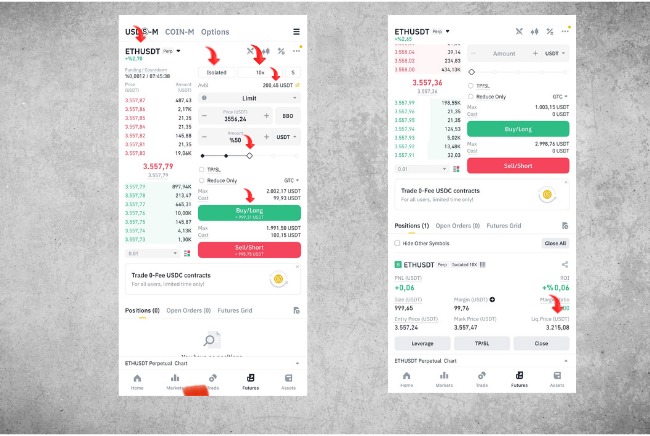

I opened the Ethereum/USDT pair. First, I’ll open an isolated position. I went to the margin mode section and selected the “Isolated” option. Isolated means that each position is only responsible for its own balance. I opened a position with around $100 using 10x leverage. I had $200 in my wallet, and now I’ve used $100 to open the position. My liquidation price is $3,215. In this position, only my $100 is at risk — nothing more. As you can see, my risk is limited.

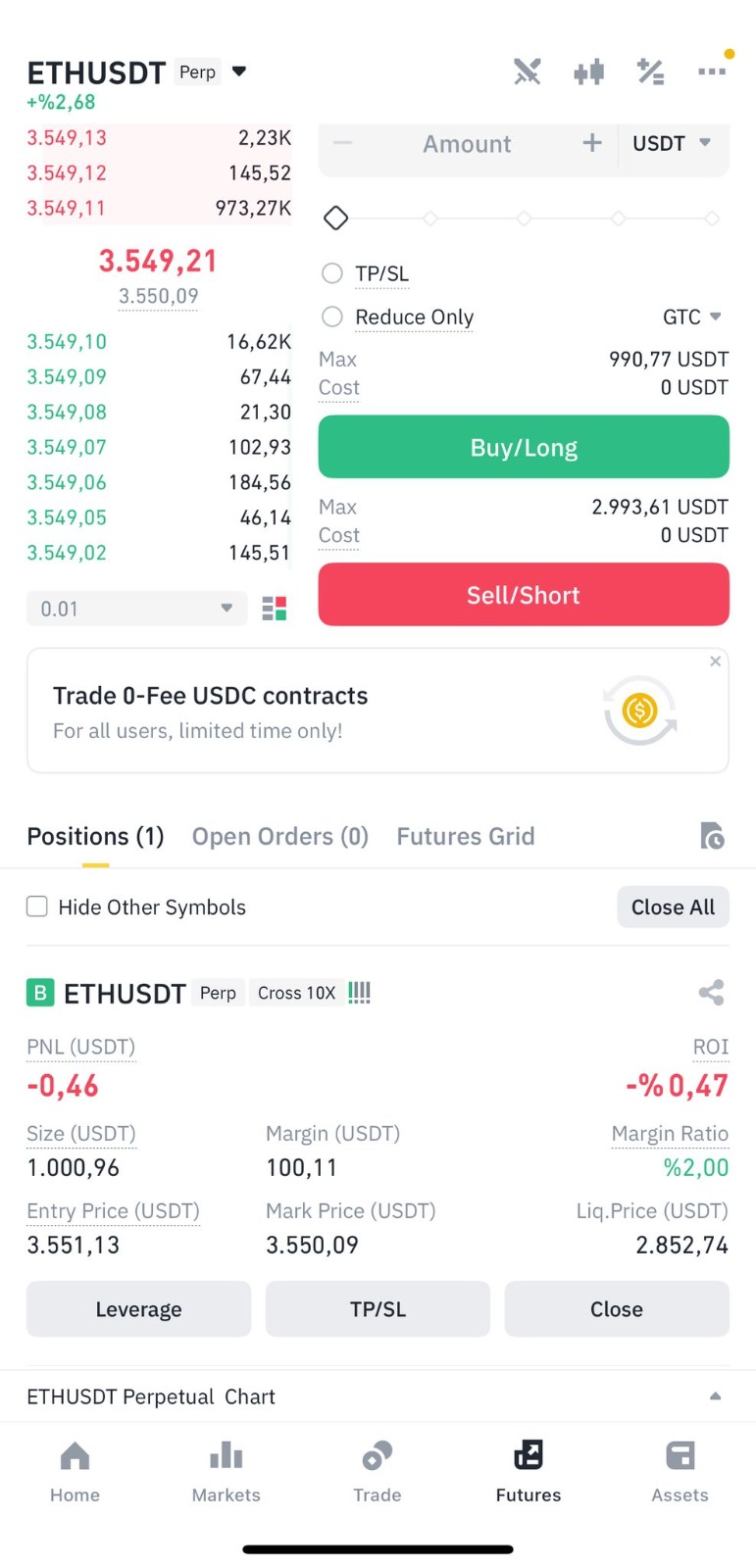

Now, I’ll open a cross position with the same cost and explain the difference. I closed my previous position and this time selected “Cross” mode. I’m opening a position with the same amount. I opened the position, and notice that my liquidation price has now dropped to $2,852. At first glance, this might seem like a good thing. But here’s the catch: if Ethereum drops to $2,852, not only is my $100 margin at risk, but all the other funds in my futures wallet are also in danger. So, while this method is more professional, isolated mode is safer for beginners.

In cross mode, your entire futures wallet balance can be used to support your positions. So if one position goes bad, the profits from other positions can help save the liquidation level. In fact, there’s even a tactic to reduce the liquidation price to zero in cross mode. I’ll share this topic in the next article.

Should I use isolated or cross? That’s a decision you need to make. For example, right now I’ve opened a $50 position in isolated mode. What I’m saying is, if this position gets liquidated, the remaining $150 in my wallet won’t be affected. I’m protecting that amount because I’m only putting $50 at risk for this specific position.

But if I open a position in cross mode, my liquidation level drops — meaning if the position goes against me, the liquidation price is farther away compared to isolated. However, if I lose, all the funds in my futures account are at risk. That’s why, if you want to use your funds more efficiently, cross mode might be the better choice.

For example, if things go badly and Ethereum drops to $2852, I can transfer funds from my spot account to my futures account to lower the liquidation price even further. This way, I can keep the position open longer without having to close it. This is a more professional way to manage positions.

But I’m saying this one last time: isolated mode is safer for beginners. Opening positions bit by bit is more efficient.

English

English